The IRS requires you to keep a diary of your winnings and losses as a prerequisite to deducting losses from your winnings. In fact, what you should do is deduct your losses only to the extent that you report your gambling winnings. For example, if you were to report you had won $5000 gambling but had losses of $20,000, this could cause a red flag. Also, only professional gamblers can write off the costs of meals, lodging and other expenses related to gambling.

Gamblers understand the concept of win some, lose some. But the IRS? It prefers exact numbers. Specifically, your tax return should reflect your total year’s gambling winnings – from the big blackjack score to the smaller fantasy football payout. That’s because you’re required to report each stroke of luck as taxable income — big or small, buddy or casino.

If you itemize your deductions, you can offset your winnings by writing off your gambling losses.

It may sound complicated, but TaxAct will walk you through the entire process, start to finish. That way, you leave nothing on the table.

How much can I deduct in gambling losses?

You can report as much as you lost in 2019 , but you cannot deduct more than you won. And you can only do this if you’re itemizing your deductions. If you’re taking the standard deduction, you aren’t eligible to deduct your gambling losses on your tax return, but you are still required to report all of your winnings.

Where do I file this on my tax forms?

Let’s say you took two trips to Vegas this year. In Trip A, you won $6,000 in poker. In the Trip B, you lost $8,000. You must list each individually, with the winnings noted on your return as taxable income and the loss as an itemized deduction in Schedule A. In this instance, you won’t owe tax on your winnings because your total loss is greater than your total win by $2,000. However, you do not get to deduct that net $2,000 loss, only the first $6,000.

Now, let’s flip those numbers. Say in Trip A, you won $8,000 in poker. In Trip B, you lost $6,000. You’ll report the $8,000 win on your return, the $6,000 loss deduction on Schedule A, and still owe taxes on the remaining $2,000 of your winnings.

What’s a W-2G? And should I have one?

A W-2G is an official withholding document; it’s typically issued by a casino or other professional gaming organization. You may receive a W-2G onsite when your payout is issued. Or, you may receive one in the mail after the fact. Gaming centers must issue W-2Gs by January 31. When they send yours, they also shoot a copy to the IRS, so don’t roll the dice: report those winnings as taxable income.

Don’t expect to get a W-2G for the $6 you won playing the Judge Judy slot machine. Withholding documents are triggered by amount of win and type of game played.

Expect to receive a W-2G tax form if you won:

- $1,200 or more on slots or bingo

- $1,500 or more on keno

- $5,000 or more in poker

- $600 or more on other games, but only if the payout is at least 300 times your wager

Can You Write Off Gambling Losses On Your Taxes Owed

Tip: Withholding only applies to your net winnings, which is your payout minus your initial wager.

What kinds of records should I keep?

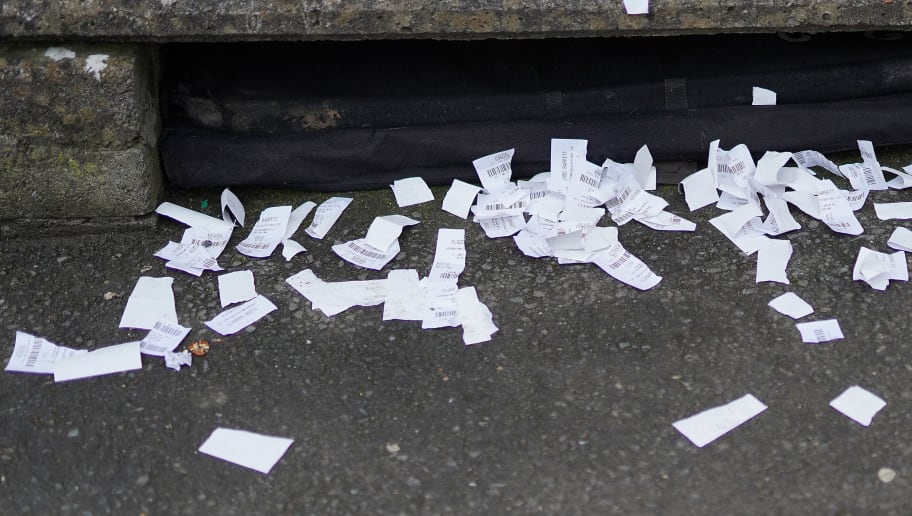

Keep a journal with lists, including: each place you’ve gambled; the day and time; who was with you; and how much you bet, won, and lost. You should also keep receipts, payout slips, wagering tickets, bank withdrawal records, and statements of actual winnings. You may also write off travel expenses associated with loss, so hang on to airfare receipts.

Use TaxAct to file your gambling wins and losses. We’ll help you find every advantage you’re owed – guaranteed.